djblisk

Distinguished Member

- Joined

- Nov 25, 2006

- Messages

- 1,572

- Reaction score

- 121

Scared money don't make no money

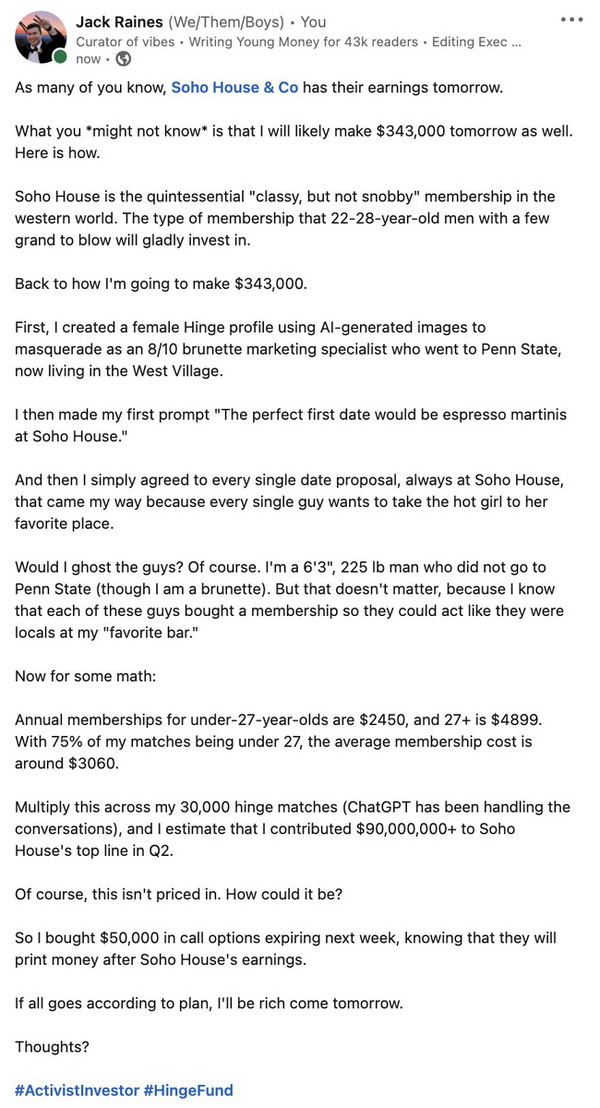

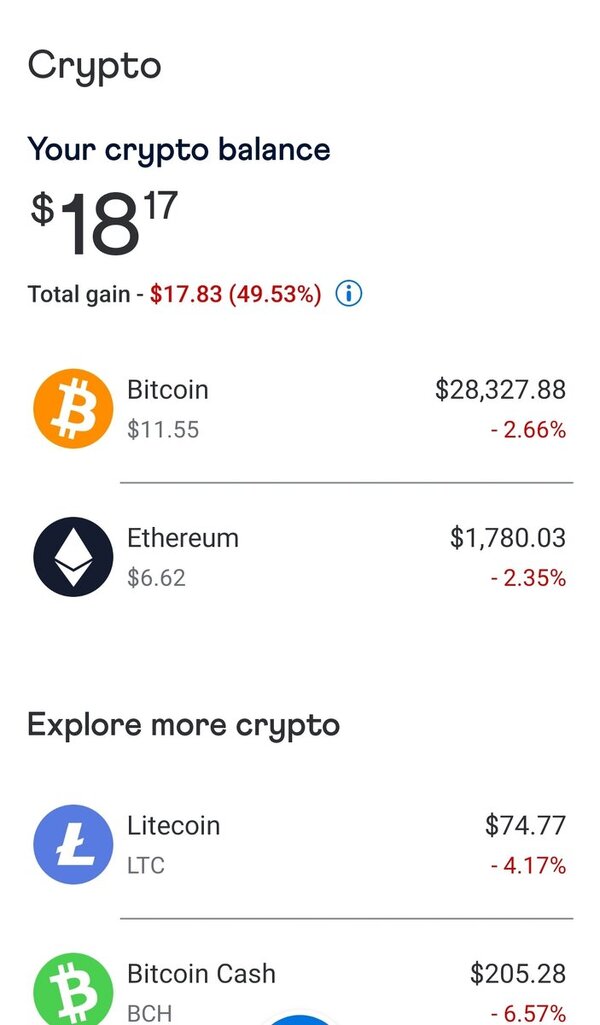

I have some money to deploy but very concerned about a serious connection looming with the interest rate hike and general private company over-unicornification filtering its way into the public markets. The research says that I should go lump sum and invest now but it also shows that 1/3 of the time you're better off dollar cost averaging and given all the indicators my gut is telling me this is more than 1/3 likely to be a better time to DCA.

What do you all think? If you had a material (to you) amount to invest right now, would you go lump sum now or would you trickle it into the market over the next 12-18 months? I'm only looking at the broader market and not temporal factors relating to individual stocks. I'm likely to invest almost exclusively in index funds (possibly just vanguard total market) because I'm prohibited from investing in a lot of the high performing stocks due to family relationships (not worth going into but sufficed to say, it's become quite a hassle to figure out what I can invest in and not worth tracking any more).

Scared money don't make no money