Support the forum

Navigation

-

- Men's Style

- Classic Menswear

- Streetwear and Denim

- Preorders, Group Made-to-order, trunk shows, and o

- Menswear Advice

- Former Affiliate Vendor Threads; a Locked Forum.

- Career and job listings in fashion, mens clothing,

-

- American Trench

- AMIDÉ HADELIN

- Archibald London

- The Armoury

- Arterton

- Besnard

- Canoe Club

- Capra Leather

- Carmina

- Cavour

- Crush Store

- De Bonne Facture

- Drinkwater's Cambridge

- Drop93

- eHABERDASHER

- Enzo Custom

- Epaulet

- Exquisite Trimmings

- Fils Unique

- Gentlemen's Footwear

- Giin

- Grant Stone

- House of Huntington

- IsuiT

- John Elliott

- Jonathan Abel

- Kent Wang

- Kirby Allison

- Larimars Clothing

- Lazy Sun

- LuxeSwap

- Luxire Custom Clothing

- Nicks Boots

- No Man Walks Alone

- Once a Day

- Passus shoes

- Proper Cloth

- SARTORIALE

- SEH Kelly

- Self Edge

- Shop the Finest

- Skoaktiebolaget

- Spier and MacKay

- Standard and Strange

- Bespoke Shoemaker Szuba

- Taylor Stitch

- TLB Mallorca

- UNI/FORM LA

- Vanda Fine Clothing

- Von Amper

- Wrong Weather

- Yeossal

- Zam Barrett

Install the app

More options

-

Hi, I am the owner and main administrator of Styleforum. If you find the forum useful and fun, please help support it by buying through the posted links on the forum. Our main, very popular sales thread, where the latest and best sales are listed, are posted HERE

Purchases made through some of our links earns a commission for the forum and allows us to do the work of maintaining and improving it. Finally, thanks for being a part of this community. We realize that there are many choices today on the internet, and we have all of you to thank for making Styleforum the foremost destination for discussions of menswear. -

This site contains affiliate links for which Styleforum may be compensated.

-

STYLE. COMMUNITY. GREAT CLOTHING.

Bored of counting likes on social networks? At Styleforum, you’ll find rousing discussions that go beyond strings of emojis.

Click Here to join Styleforum's thousands of style enthusiasts today!

Styleforum is supported in part by commission earning affiliate links sitewide. Please support us by using them. You may learn more here.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

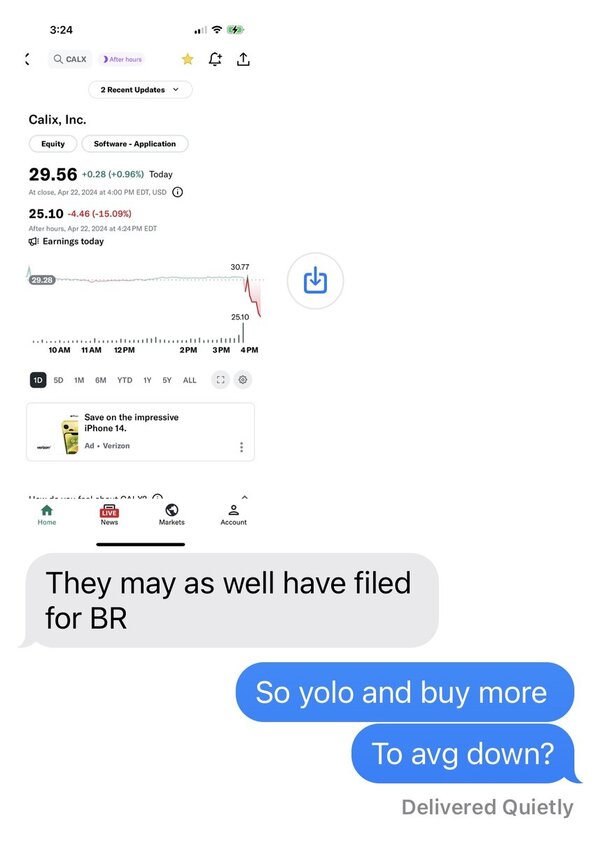

Talking stocks, trading, and investing in general

- Thread starter mikeman

- Start date

- Watchers 332

JSSM

Well-Known Member

- Joined

- May 28, 2011

- Messages

- 54

- Reaction score

- 0

Too much emotion man, how's your algo gonna work when you start losing money?

Haha, well, I haven't cut my losses yet. I'm waiting til close as I'm supposed to.

I mean, we're still up 8% overall, but it sucks.

Waiting until the close? If you need to wait for an arbitrary point in time to close a trade, that is a weakness. I assume you trade an end-of-day system.

I started buying on my own this summer and am up 8.42% today. I own a lot of volatile stocks though so I've been between 3%-22% or so returns this summer. I did a lot of paper trades before though and have taken a few finance and portfolio management classes.

Technically if you take out the past 10 years, everyone was guaranteed to make a net profit. A better measure is if you beat the benchmark (S&P or MSCI) since that shows your actual performance.

Classes...

A profit isn't necessarily a profit. Factor in inflation, opportunity cost, variance etc. And no, comparison with an index does not necessarily reflect performance, as there is no consideration of risk. Achieving the index return is the sign of a horrible trader (unless the variance is extremely low, in which case the trader will attract huge capital) - a small, decently skilled trader will be ale to achieve a far greater return than a highly skilled but massive trader. If you don't understand why, well, it's Trading 101.

I've made quite a bit of profit and beat the s&p by a lot.

Anyone with that bought with leverage could say the same.

Last edited:

CYstyle

Distinguished Member

- Joined

- Jul 18, 2009

- Messages

- 1,219

- Reaction score

- 24

Anyone who buys with leverage can also be broke?

Anyone with that bought with leverage could say the same.

Anyone who buys with leverage can also be broke?

JSSM

Well-Known Member

- Joined

- May 28, 2011

- Messages

- 54

- Reaction score

- 0

Anyone with that bought with leverage could say the same.

Anyone who buys with leverage can also be broke?

And that's why return is not indicative of skill without analysis of the trades and method used to achieve it. Within reason of course; being down 30% after a single trade does suggest poor risk management (it could be mathematically justifiable for a good trader, but it's pushing it).

Charley

Distinguished Member

- Joined

- Feb 18, 2005

- Messages

- 2,605

- Reaction score

- 6

Pretty interesting Bloomberg interview with Jim Grant.

The ECB is putting on the MF Global trade, with maybe higher leverage. The ECB is not subject to any Mark to Market requirements, until they finally are, one day, by the market. Of course, the US FRB is more leveraged than the ECB. Neither could pass the Basel banking standards that they are requireing of the private banks for financial safety.

Double dip or not, Eurozone is going to be a repeat of Japan, in a jersey shore manner. It has to let bank fail and let countries default. Or have a common fiscal entity and print the **** out of it, like the Fed's strat.

Pretty interesting Bloomberg interview with Jim Grant.

The ECB is putting on the MF Global trade, with maybe higher leverage. The ECB is not subject to any Mark to Market requirements, until they finally are, one day, by the market. Of course, the US FRB is more leveraged than the ECB. Neither could pass the Basel banking standards that they are requireing of the private banks for financial safety.

GreenFrog

Stylish Dinosaur

- Joined

- Oct 20, 2008

- Messages

- 13,767

- Reaction score

- 2,935

Crazy, crazy stock market..

Monday it'll be down 2% because of bad news from the Eurozone over the weekend. Then Tuesday it'll shoot back up 3%, followed by a 0.2% gain on Wednesday, a 2.5% loss on Thursday, and a 3.2% gain on Friday.

Monday it'll be down 2% because of bad news from the Eurozone over the weekend. Then Tuesday it'll shoot back up 3%, followed by a 0.2% gain on Wednesday, a 2.5% loss on Thursday, and a 3.2% gain on Friday.

Yup. So far my algo has been hitting most of it correctly. We're up about 24% since Oct 24th. We just hit the big gain today as well as the big loss a couple days ago.

Crazy, crazy stock market..

Monday it'll be down 2% because of bad news from the Eurozone over the weekend. Then Tuesday it'll shoot back up 3%, followed by a 0.2% gain on Wednesday, a 2.5% loss on Thursday, and a 3.2% gain on Friday.

Yup. So far my algo has been hitting most of it correctly. We're up about 24% since Oct 24th. We just hit the big gain today as well as the big loss a couple days ago.

Charley

Distinguished Member

- Joined

- Feb 18, 2005

- Messages

- 2,605

- Reaction score

- 6

It really is a dangerous market to trade. There has not been anything like this for at least 75 years, and even that period cannot encompas a period that has these risk metrics. Trade from a 1/2 position. don't try to be bold. Rational economics have very little to do with what is happening in the markets. There are very few people alive who experienced the Great Depression. The Depression was very real for those who experienced it. Preservation of capital (assets) was the successful strategy as the values of everything declined, except what you owed in debt.

A report on how the fraudulent Euro support game is being played by the EFSF:

European Ponzi Goes Full marsupial As EFSF Found To Monetize... Itself

The dipwads bought their own bonds with whatever real cash was in the pot. It makes for a great auction. If anyone is sucker enough to believe the yields, they will have an opportunity in the secondary market to buy the unsold crap.

And this is the fund that will buy all of the Greece and Italy and Ireland and Spain bond issues for the next two years or more.

Hey. What Do I Know.

I drink Fitzgerald.

Crazy, crazy stock market..

Monday it'll be down 2% because of bad news from the Eurozone over the weekend. Then Tuesday it'll shoot back up 3%, followed by a 0.2% gain on Wednesday, a 2.5% loss on Thursday, and a 3.2% gain on Friday.

It really is a dangerous market to trade. There has not been anything like this for at least 75 years, and even that period cannot encompas a period that has these risk metrics. Trade from a 1/2 position. don't try to be bold. Rational economics have very little to do with what is happening in the markets. There are very few people alive who experienced the Great Depression. The Depression was very real for those who experienced it. Preservation of capital (assets) was the successful strategy as the values of everything declined, except what you owed in debt.

A report on how the fraudulent Euro support game is being played by the EFSF:

European Ponzi Goes Full marsupial As EFSF Found To Monetize... Itself

The dipwads bought their own bonds with whatever real cash was in the pot. It makes for a great auction. If anyone is sucker enough to believe the yields, they will have an opportunity in the secondary market to buy the unsold crap.

And this is the fund that will buy all of the Greece and Italy and Ireland and Spain bond issues for the next two years or more.

Hey. What Do I Know.

I drink Fitzgerald.

Last edited:

GreenFrog

Stylish Dinosaur

- Joined

- Oct 20, 2008

- Messages

- 13,767

- Reaction score

- 2,935

Yeah, I mean, it's a risky market with huge potential for losses, but there are also so many opportunities to make huge profits. Granted, an overwhelmingly small minority of active investors will actually be savvy enough to make a **** ton of money in today's stock market, but from what I know about the best traders out there, they love volatility.

Slopho

Distinguished Member

- Joined

- Jan 8, 2009

- Messages

- 5,291

- Reaction score

- 12

Aww crap, guess who just got out of the Stem Cell game.

After a conversation with my fulbright scholarship friend at MIT about the future of stem cells, I decided to buy 5000 shares of GERN this morning. 13 percent rally before the day is out.

Aww crap, guess who just got out of the Stem Cell game.

stevent

Distinguished Member

- Joined

- Feb 16, 2010

- Messages

- 9,564

- Reaction score

- 1,483

Yeah, but with these types of stocks you gotta factor in these risks

?

That's nuts!!! I bet GERN investors are not too happy right now.

Yeah, but with these types of stocks you gotta factor in these risks

FEATURED PRODUCTS

-

LuxeSwap Auction - Manolo Blahnik Brown Wholecut Leather Loafers One of several examples of fine footwear offered this week by LuxeSwap at a $9.99 opening bid, no reserve auction, an scarce example of a mens shoe by Manolo Blahnik is crafted on a last reminiscent of Gaziano & Girlings fabled TG73 last. A very fine pair in near mint condition.

LuxeSwap Auction - Manolo Blahnik Brown Wholecut Leather Loafers One of several examples of fine footwear offered this week by LuxeSwap at a $9.99 opening bid, no reserve auction, an scarce example of a mens shoe by Manolo Blahnik is crafted on a last reminiscent of Gaziano & Girlings fabled TG73 last. A very fine pair in near mint condition. -

Nicks Handmade Boots Americana - 60th Anniversary Sale! Fashioned after the classic service boot style, the Americana offers a timeless look on the HNW Last. This boot is built on the same last and has the same heel height as the Falcon.

-

eHaberdasher - Bella Spalla Trousers - $135 Here is a beautiful pair of trousers from Benjamin Bella Spalla Napoli Collection. These trousers offer true quality and luxury with a slimmer and flattering silhouette with sartorial features including a triple button closure and V-split waist in back for extra comfort.

Latest posts

- Replies

- 15,069

- Views

- 1,170,035

- Replies

- 2

- Views

- 620

- Replies

- 3,876

- Views

- 978,145

Similar threads

- Replies

- 77

- Views

- 131,816

Featured Sponsor

Forum Sponsors

- American Trench

- AMIDÉ HADELIN

- Archibald London

- The Armoury

- Arterton

- Besnard

- Canoe Club

- Capra Leather

- Carmina

- Cavour

- Crush Store

- De Bonne Facture

- Drinkwater's Cambridge

- Drop93

- eHABERDASHER

- Enzo Custom

- Epaulet

- Exquisite Trimmings

- Fils Unique

- Gentlemen's Footwear

- Giin

- Grant Stone

- House of Huntington

- IsuiT

- John Elliott

- Jonathan Abel

- Kent Wang

- Kirby Allison

- Larimars Clothing

- Lazy Sun

- LuxeSwap

- Luxire Custom Clothing

- Nicks Boots

- No Man Walks Alone

- Once a Day

- Passus shoes

- Proper Cloth

- SARTORIALE

- SEH Kelly

- Self Edge

- Shop the Finest

- Skoaktiebolaget

- Spier and MacKay

- Standard and Strange

- Bespoke Shoemaker Szuba

- Taylor Stitch

- TLB Mallorca

- UNI/FORM LA

- Vanda Fine Clothing

- Von Amper

- Wrong Weather

- Yeossal

- Zam Barrett

Members online

- Hombre Secreto

- Keeper11

- Jagger_On

- PorterInjax

- malcb33

- brokencycle

- MJMcRibb

- Glourie

- Egdon Heath

- Ratty

- dinted voice

- sartoria vacua

- Awcine

- Naughton

- verver

- Mr Stevens

- grio1212

- feliks

- Jr Mouse

- tim_horton

- Using Technology

- zissou

- Bärensohn

- wolfdale

- blaxploitation

- DeBo

- tahitiantreat

- camez_

- PhantomThread

- DJYello

- GG Allin

- DinhoT51

- lagsun

- jalh97

- nbernie

- unclemilty

- Beav

- AHS

- Baron

- Brantley11

- VintageZealot

- goonerble

- 45bur

- Jaker12

- mikejb

- sighohwell

- paddymac

- cybersushi

- Bobbo316

Total: 3,138 (members: 82, guests: 3,056)