Too small a sample yet, but I'm (in simulation) up about 3.2% on SPY and 10% on UPRO since Oct 24th. The Market is up by less than 1% since then. Also today is looking good. Long yesterday, made some fake money, short today, hopefully this holds.

Support the forum

Navigation

-

- Men's Style

- Classic Menswear

- Streetwear and Denim

- Preorders, Group Made-to-order, trunk shows, and o

- Menswear Advice

- Former Affiliate Vendor Threads; a Locked Forum.

- Career and job listings in fashion, mens clothing,

-

- American Trench

- AMIDÉ HADELIN

- Archibald London

- The Armoury

- Arterton

- Besnard

- Canoe Club

- Capra Leather

- Carmina

- Cavour

- Crush Store

- De Bonne Facture

- Drinkwater's Cambridge

- Drop93

- eHABERDASHER

- Enzo Custom

- Epaulet

- Exquisite Trimmings

- Fils Unique

- Gentlemen's Footwear

- Giin

- Grant Stone

- House of Huntington

- IsuiT

- John Elliott

- Jonathan Abel

- Kent Wang

- Kirby Allison

- Larimars Clothing

- Lazy Sun

- LuxeSwap

- Luxire Custom Clothing

- Nicks Boots

- No Man Walks Alone

- Once a Day

- Passus shoes

- Proper Cloth

- SARTORIALE

- SEH Kelly

- Self Edge

- Shop the Finest

- Skoaktiebolaget

- Spier and MacKay

- Standard and Strange

- Bespoke Shoemaker Szuba

- Taylor Stitch

- TLB Mallorca

- UNI/FORM LA

- Vanda Fine Clothing

- Von Amper

- Wrong Weather

- Yeossal

- Zam Barrett

Install the app

More options

-

Hi, I am the owner and main administrator of Styleforum. If you find the forum useful and fun, please help support it by buying through the posted links on the forum. Our main, very popular sales thread, where the latest and best sales are listed, are posted HERE

Purchases made through some of our links earns a commission for the forum and allows us to do the work of maintaining and improving it. Finally, thanks for being a part of this community. We realize that there are many choices today on the internet, and we have all of you to thank for making Styleforum the foremost destination for discussions of menswear. -

This site contains affiliate links for which Styleforum may be compensated.

-

STYLE. COMMUNITY. GREAT CLOTHING.

Bored of counting likes on social networks? At Styleforum, you’ll find rousing discussions that go beyond strings of emojis.

Click Here to join Styleforum's thousands of style enthusiasts today!

Styleforum is supported in part by commission earning affiliate links sitewide. Please support us by using them. You may learn more here.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

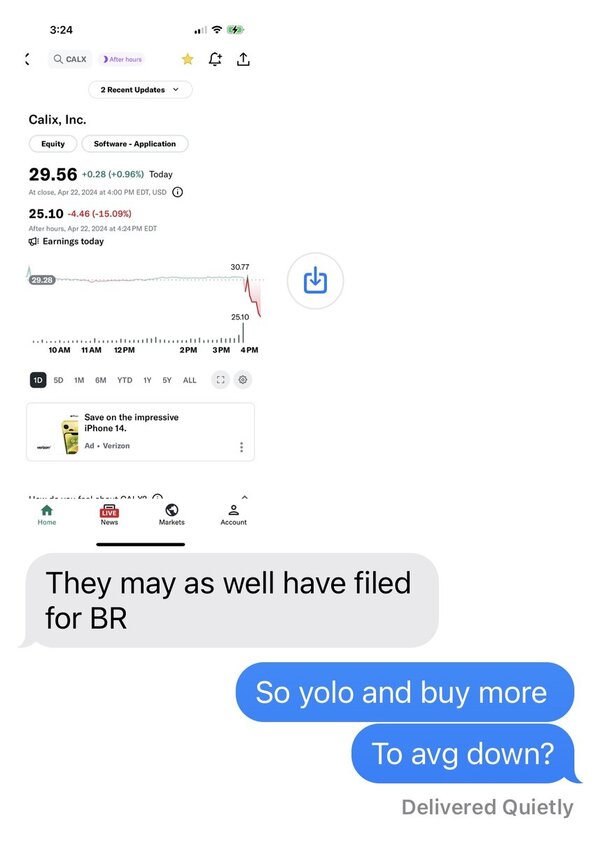

Talking stocks, trading, and investing in general

- Thread starter mikeman

- Start date

- Watchers 332

stevent

Distinguished Member

- Joined

- Feb 16, 2010

- Messages

- 9,564

- Reaction score

- 1,483

What's your tracking error and Treynor ratio right now?

Too small a sample yet, but I'm (in simulation) up about 3.2% on SPY and 10% on UPRO since Oct 24th. The Market is up by less than 1% since then. Also today is looking good. Long yesterday, made some fake money, short today, hopefully this holds.

What's your tracking error and Treynor ratio right now?

Too small a sample yet, but I'm (in simulation) up about 3.2% on SPY and 10% on UPRO since Oct 24th. The Market is up by less than 1% since then. Also today is looking good. Long yesterday, made some fake money, short today, hopefully this holds.

What's your tracking error and Treynor ratio right now?

No idea. Let me wiki what those are and get back to you.

stevent

Distinguished Member

- Joined

- Feb 16, 2010

- Messages

- 9,564

- Reaction score

- 1,483

You should build spreadsheet with all the typical ratios, you'll need it eventually for your prospectus anyways

No idea. Let me wiki what those are and get back to you.

You should build spreadsheet with all the typical ratios, you'll need it eventually for your prospectus anyways

Yeah, I need to figure out how to calculate Sharpe ratio and all that.

I'm not sure what the Treynor ratio on our backtesting is, but I'm sure it's quite high -- there's no way our beta is particularly high in the long run. Our returns tend to be fairly consistent irrespective of what the market is doing. The thing our performance is most closely linked to is volatility. Higher = better.

edit: bluh, and today just turned ******.

You should build spreadsheet with all the typical ratios, you'll need it eventually for your prospectus anyways

Yeah, I need to figure out how to calculate Sharpe ratio and all that.

I'm not sure what the Treynor ratio on our backtesting is, but I'm sure it's quite high -- there's no way our beta is particularly high in the long run. Our returns tend to be fairly consistent irrespective of what the market is doing. The thing our performance is most closely linked to is volatility. Higher = better.

edit: bluh, and today just turned ******.

Last edited:

I think the vicious circle has already begun. I don't know that the ECB is going to rise to the occasion -- they certainly haven't demonstrated any capacity for that thus far. I think this is the end of the Euro as we know it.

Brutal day, but we were short so we're looking good still in simulation. up about 19% since beginning on oct 24th.

I'm legitimately scared that Italy might go under.. if that happens.. hello, double dip..

I think the vicious circle has already begun. I don't know that the ECB is going to rise to the occasion -- they certainly haven't demonstrated any capacity for that thus far. I think this is the end of the Euro as we know it.

Brutal day, but we were short so we're looking good still in simulation. up about 19% since beginning on oct 24th.

Charley

Distinguished Member

- Joined

- Feb 18, 2005

- Messages

- 2,605

- Reaction score

- 6

The ECB is specifically prohibited from directly buying bonds of the member nations. But the Euro Zone has never followed or enforced any of the other governing rules so this one may not hold either. The game is over when the German public becomes informed of the liabilities that are being piled upon them.

Charley

Distinguished Member

- Joined

- Feb 18, 2005

- Messages

- 2,605

- Reaction score

- 6

A Sharpe ratio is a measure that is commonly presented and is supposed to possibly be some measure of risk. Generally, it is supposed to tell you if you were paid adequately for the risk you took. However, look a bit further into these types of ratios and I believe that the logic behind the Ulcer Index for risk comparison is much better. Sharpe does not really give the possiblilty of a large drawdown adequate weighting. Just because the model or plan survived it does not make it any more pleasant in real time, or keep you from questioning the plan during those periods. Most people find it hard to continue with a program that has generated a 30% or greater drawdown.

Yeah, I need to figure out how to calculate Sharpe ratio and all that.

I'm not sure what the Treynor ratio on our backtesting is, but I'm sure it's quite high -- there's no way our beta is particularly high in the long run. Our returns tend to be fairly consistent irrespective of what the market is doing. The thing our performance is most closely linked to is volatility. Higher = better.

edit: bluh, and today just turned ******.

A Sharpe ratio is a measure that is commonly presented and is supposed to possibly be some measure of risk. Generally, it is supposed to tell you if you were paid adequately for the risk you took. However, look a bit further into these types of ratios and I believe that the logic behind the Ulcer Index for risk comparison is much better. Sharpe does not really give the possiblilty of a large drawdown adequate weighting. Just because the model or plan survived it does not make it any more pleasant in real time, or keep you from questioning the plan during those periods. Most people find it hard to continue with a program that has generated a 30% or greater drawdown.

Last edited:

Yeah, I find all these ratios pretty questionable for anything other than ranking a set of similar strategies under a single roof -- and even then it's debatable how useful they are. Our Sharpe isn't great -- about 0.14. Which is odd, because we never really have huge drawdowns, but there's a lot of variation before we close our positions. There's a lot of paper losses that never get realized but that get factored into a Sharpe. Without those, our ratio is more like 0.27. We have a pretty great beta though, at about 0.078, and our Treynor ratio is quite high.

But, again, how useful these all are -- who the **** knows. Still, some hedge fund guys we're in talks with want to see this ****, so see it they shall.

A Sharpe ratio is a measure that is commonly presented and is supposed to possibly be some measure of risk. Generally, it is supposed to tell you if you were paid adequately for the risk you took. However, look a bit further into these types of ratios and I believe that the logic behind the Ulcer Index for risk comparison is much better. Sharpe does not really give the possiblilty of a large drawdown adequate weighting. Just because the model or plan survived it does not make it any more pleasant in real time, or keep you from questioning the plan during those periods. Most people find it hard to continue with a program that has generated a 30% or greater drawdown.

Yeah, I find all these ratios pretty questionable for anything other than ranking a set of similar strategies under a single roof -- and even then it's debatable how useful they are. Our Sharpe isn't great -- about 0.14. Which is odd, because we never really have huge drawdowns, but there's a lot of variation before we close our positions. There's a lot of paper losses that never get realized but that get factored into a Sharpe. Without those, our ratio is more like 0.27. We have a pretty great beta though, at about 0.078, and our Treynor ratio is quite high.

But, again, how useful these all are -- who the **** knows. Still, some hedge fund guys we're in talks with want to see this ****, so see it they shall.

chogall

Distinguished Member

- Joined

- Aug 12, 2011

- Messages

- 6,562

- Reaction score

- 1,166

I think the vicious circle has already begun. I don't know that the ECB is going to rise to the occasion -- they certainly haven't demonstrated any capacity for that thus far. I think this is the end of the Euro as we know it.

Brutal day, but we were short so we're looking good still in simulation. up about 19% since beginning on oct 24th.

Double dip or not, Eurozone is going to be a repeat of Japan, in a jersey shore manner. It has to let bank fail and let countries default. Or have a common fiscal entity and print the **** out of it, like the Fed's strat.

FEATURED PRODUCTS

-

LuxeSwap Auction - Manolo Blahnik Brown Wholecut Leather Loafers One of several examples of fine footwear offered this week by LuxeSwap at a $9.99 opening bid, no reserve auction, an scarce example of a mens shoe by Manolo Blahnik is crafted on a last reminiscent of Gaziano & Girlings fabled TG73 last. A very fine pair in near mint condition.

LuxeSwap Auction - Manolo Blahnik Brown Wholecut Leather Loafers One of several examples of fine footwear offered this week by LuxeSwap at a $9.99 opening bid, no reserve auction, an scarce example of a mens shoe by Manolo Blahnik is crafted on a last reminiscent of Gaziano & Girlings fabled TG73 last. A very fine pair in near mint condition. -

Nicks Handmade Boots Americana - 60th Anniversary Sale! Fashioned after the classic service boot style, the Americana offers a timeless look on the HNW Last. This boot is built on the same last and has the same heel height as the Falcon.

-

eHaberdasher - Bella Spalla Trousers - $135 Here is a beautiful pair of trousers from Benjamin Bella Spalla Napoli Collection. These trousers offer true quality and luxury with a slimmer and flattering silhouette with sartorial features including a triple button closure and V-split waist in back for extra comfort.

Latest posts

- Replies

- 23,921

- Views

- 3,702,196

- Replies

- 8,836

- Views

- 2,411,856

- Replies

- 20,961

- Views

- 1,119,566

- Replies

- 15,069

- Views

- 1,170,035

Similar threads

- Replies

- 77

- Views

- 131,816

Featured Sponsor

Forum Sponsors

- American Trench

- AMIDÉ HADELIN

- Archibald London

- The Armoury

- Arterton

- Besnard

- Canoe Club

- Capra Leather

- Carmina

- Cavour

- Crush Store

- De Bonne Facture

- Drinkwater's Cambridge

- Drop93

- eHABERDASHER

- Enzo Custom

- Epaulet

- Exquisite Trimmings

- Fils Unique

- Gentlemen's Footwear

- Giin

- Grant Stone

- House of Huntington

- IsuiT

- John Elliott

- Jonathan Abel

- Kent Wang

- Kirby Allison

- Larimars Clothing

- Lazy Sun

- LuxeSwap

- Luxire Custom Clothing

- Nicks Boots

- No Man Walks Alone

- Once a Day

- Passus shoes

- Proper Cloth

- SARTORIALE

- SEH Kelly

- Self Edge

- Shop the Finest

- Skoaktiebolaget

- Spier and MacKay

- Standard and Strange

- Bespoke Shoemaker Szuba

- Taylor Stitch

- TLB Mallorca

- UNI/FORM LA

- Vanda Fine Clothing

- Von Amper

- Wrong Weather

- Yeossal

- Zam Barrett

Members online

- Jerkstore

- PhantomThread

- Crafty Cumbrian

- alihos

- thatboyo

- zargoz

- grio1212

- sungmineyo

- hpreston

- ptfly

- yungr1

- An Acute Style

- EvanLovejoy

- XxLogo

- Brantley11

- delmar

- zippyh

- noretailplease

- kakishiboo

- teddieriley

- matic

- I_Adler

- jalh97

- Mghart

- lagsun

- CLH03

- sjmin209

- Watchman1

- afan

- zranger102797

- Woofa

- WBaker

- jhuetsch

- BigRed

- Alias

- kennyg2626

- KotaB

- trafficjam

- Jr Mouse

- oldripper

- Jimba

- kid1002

- pocketsquared

- sushijerk

- Jalen

- Watty

- ChorizoHowitzer

- mo56029

- jrod721

- Duke Silver

Total: 1,777 (members: 96, guests: 1,681)