- Joined

- Apr 26, 2008

- Messages

- 28,683

- Reaction score

- 37,730

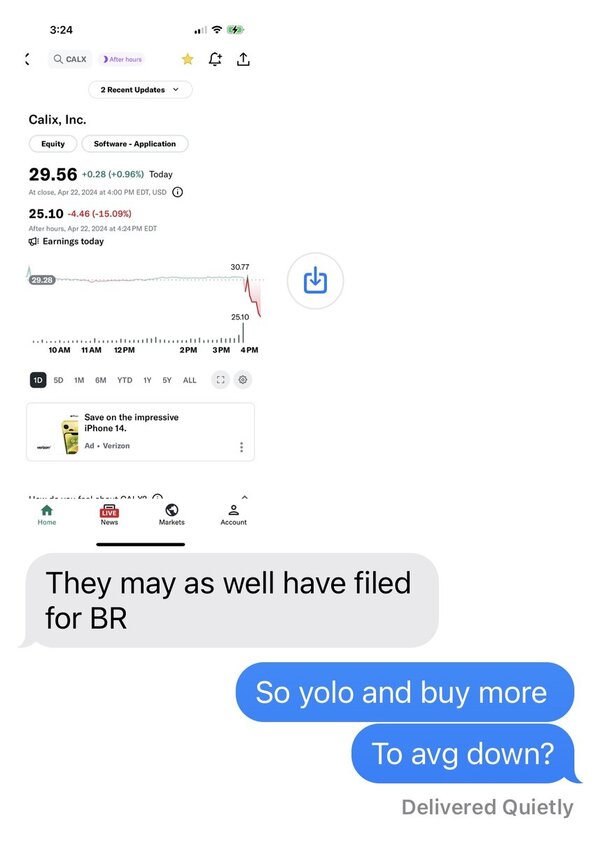

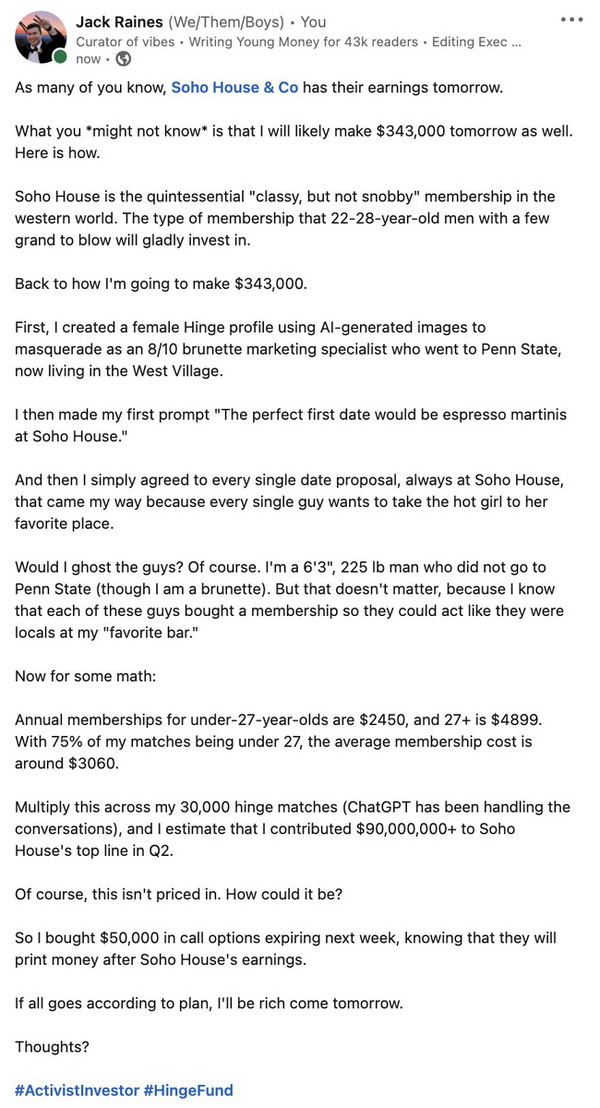

Invest in Rolex watches! Is that still a thing or have we moved past that?If we implode, your stocks (or bonds) aren't going to be worth anything anything, and neither is the dollar, so you might as well keep everything in the market.