amerikajinda

Distinguished Member

- Joined

- Apr 18, 2006

- Messages

- 9,929

- Reaction score

- 223

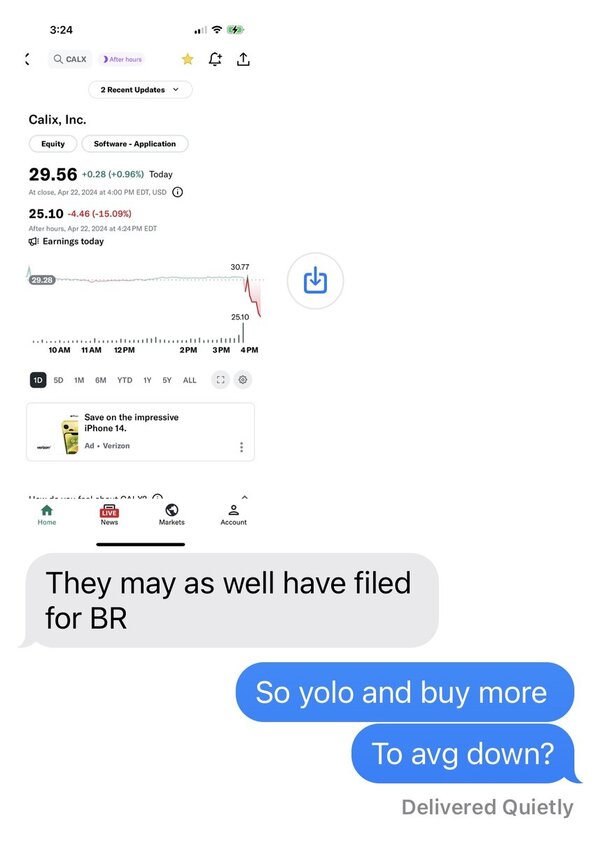

1) equities are not Pokémon

2) a dividend portfolio with no EPD or Ares? D'allors!

Thank you! I just picked up some EPD but in looking at Ares... the price to economic book value ratio doesn't look good and their free cash flow yield is not that good either and most importantly their return on invested capital is really ugly. Economic book value is weak but I'm liking EPD so thank you for that!

Well I do seem to collect stocks like Pokémon but I just want to make sure I have some individual representation in all of the eleven sectors.