I'd hold FCX for the long term. I think they'll be okay.

GPRO is dicey. I don't believe in the product and I'm iffy on mgmt. They could be an acquisition target, but even then I wonder who would buy them.

I think they're heavily oversold, however, and would expect to see a nice bounce within a couple weeks. Might offload then.

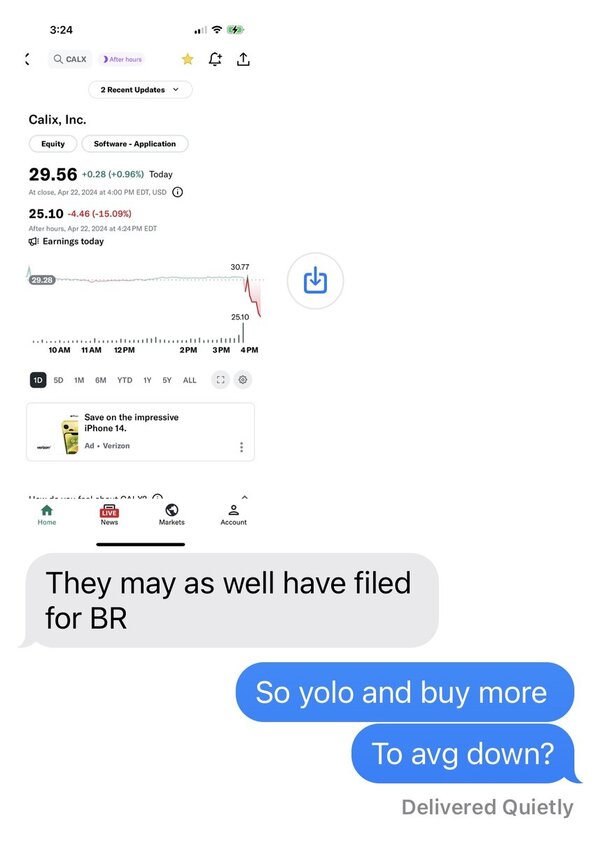

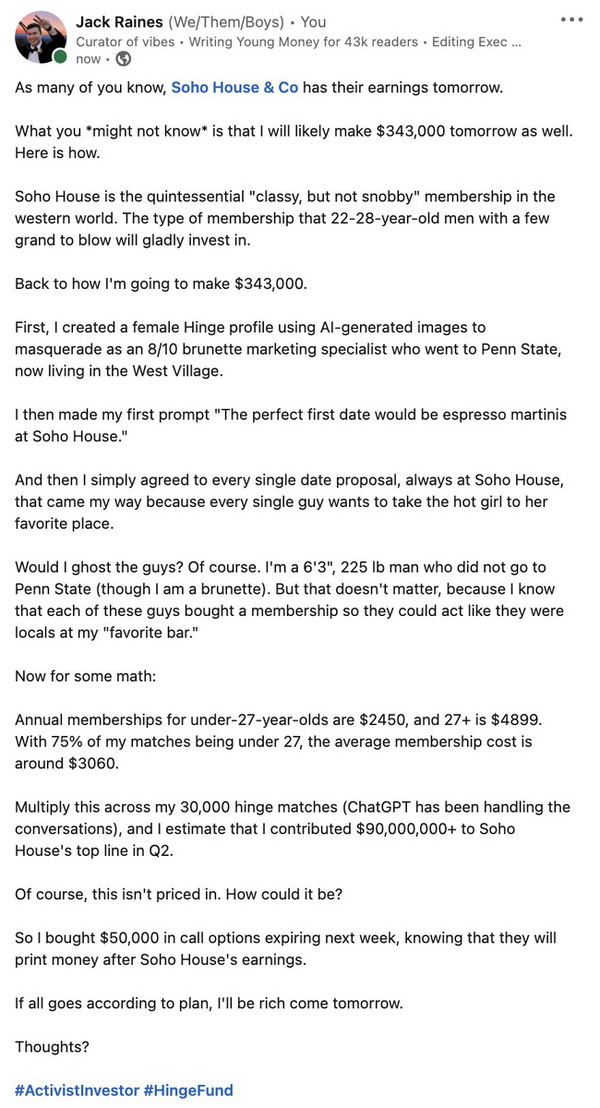

Their December quarter is down ~31% Y/Y. Negative 31% Y/Y growth for a supposedly high growth company. And it won't be able to prove itself as a growth company until this time next year, with their ~45% December quarter sales weighting, in my humble opinion.

I could say a lot of negative things about the company, but it has ~$3.5/share cash and someone crazy might rescue and buy out this rich boy's toy company.

I feel the same way about FCX. While it stings now, I think it'll be worthwhile in the long term.

GPRO is a much bigger concern. They're such a conflicted business. Sales are down and management is suspect, while P/E, EBITDA, Cash, and lack of debt are really strong. It's without question they're oversold, but who knows if or when the market will allow it to recover. Hopefully we can get some pop or an acquisition, so I can get near breakeven and cash out.