idfnl

Stylish Dinosaur

- Joined

- Dec 6, 2008

- Messages

- 17,305

- Reaction score

- 1,260

OMG holy **** incredible.... went from -20% to up 15% !!!!!!!!!!!!!!!!!!!!!!

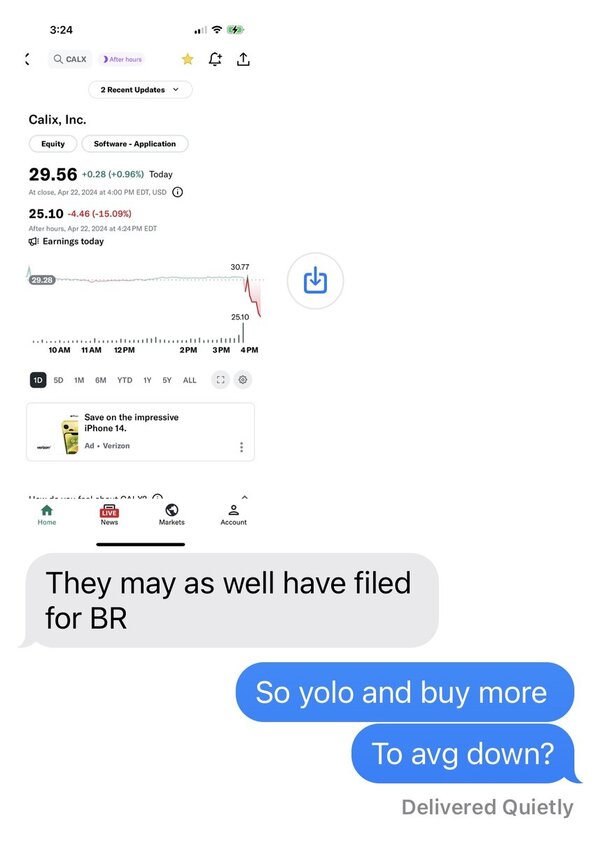

25.39

+3.21 (14.47%)

I've never seen a turnaround like this in my entire life. Wow.

saw that too. Bought some more when it was down. Wasn't fast enough to catch it under 19 (gf was chatting to me on the phone lol) so instead of high 18's got it at around 19.5. Just averaging down on this position.

Also bought some more COS under $10.

Still staking out SCTY and TSLA if they go low enough, will add some more.

Lumber Liquidaters (LL) made a nice big jump back up. Hey it's nearly where I bought it oy. Long term I don't think these guys will get over what just happened, true or not. I saw it go from 60 to 50 to 40 (where I bought) to 30, now back up to 37... if it ever makes it close to 50 I'm out, maybe even sooner. I like volatility but this one might just crash and burn.

I'm hearing quite a few things about Clorox (CLX), at least a few opinions are suggesting they're going to do well.

Also Under Armour (UA) has some good rumors for mid-long growth potential. I don't like buying when it's so high just on principle, but I'm keeping an eye on this one.

Oh and lastly, Disney (DIS) also has some good vibes around it...

OMG holy **** incredible.... went from -20% to up 15% !!!!!!!!!!!!!!!!!!!!!!

25.39

+3.21 (14.47%)

I've never seen a turnaround like this in my entire life. Wow.