idfnl

Stylish Dinosaur

- Joined

- Dec 6, 2008

- Messages

- 17,305

- Reaction score

- 1,260

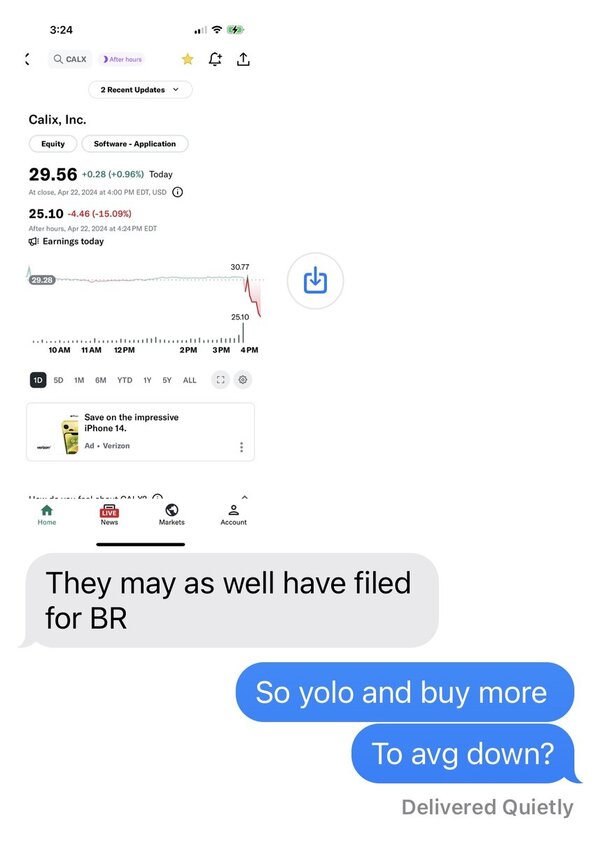

I bought 300. It was down today, so I'll try and build a position thru it dropping. If it pops from here, great. I'll nibble again if it drops below fiddy cent. If I can get 1000 shares at a good level I'll let it ride. I don't want to drop any more than that into it at this point because of regulatory uncertainty. If we get some Federal clarity it could really go.

FB may touch that level but there is a lot of institutional buying and that quarter they just had was pretty perfect.

As for TSLA, I think you missed the train. We could see 350 or 150. Who knows. Initiating at this level is very risky.

I just bought 750 shares for fun (all the cash I had in my account). It might be priced too high now although it could go higher. TD Ameritrade for whatever reason is no longer requiring a broker to initiate a position.

Of course when I first wanted to buy it, it was only 7c a share....I was probably going to buy $500-$1000 worth which would now be worth up to $7500 which would have been worth the $44.99 fee for trading with a broker.

I bought 300. It was down today, so I'll try and build a position thru it dropping. If it pops from here, great. I'll nibble again if it drops below fiddy cent. If I can get 1000 shares at a good level I'll let it ride. I don't want to drop any more than that into it at this point because of regulatory uncertainty. If we get some Federal clarity it could really go.

[I'm looking to get into FB at under $65 so I set some price triggers. Hoping to get in before the next earnings release.

As for TSLA.. man I have no words for this stock. It defies all logic and reason. I'd be scared to get in right now as I think the downside risk is much, much higher right now. But I was saying that at $140, too.

FB may touch that level but there is a lot of institutional buying and that quarter they just had was pretty perfect.

As for TSLA, I think you missed the train. We could see 350 or 150. Who knows. Initiating at this level is very risky.

![Baldy[1] :brick: :brick:](/styleforum_ads/smilies/baldy[1].gif)