Slopho

Distinguished Member

- Joined

- Jan 8, 2009

- Messages

- 5,291

- Reaction score

- 12

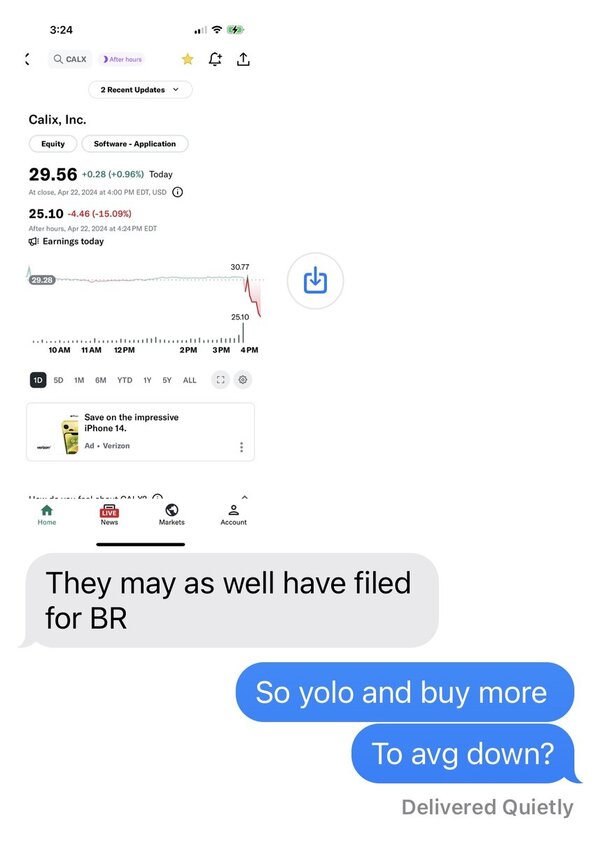

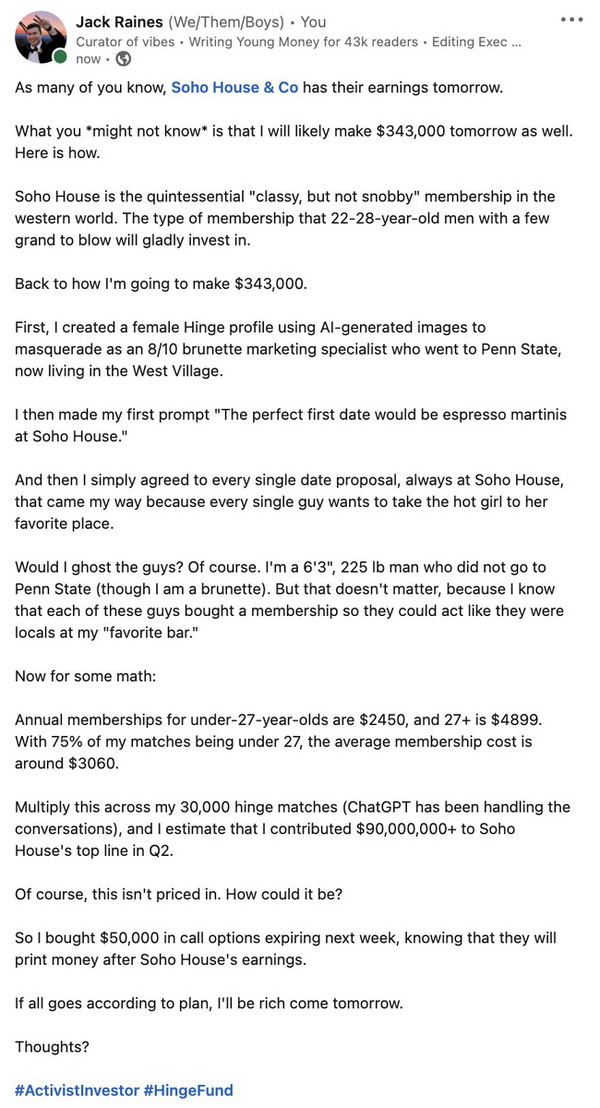

Its never wrong to make a profit.

I traded NFLX on friday for a nice gain...perhaps I should have held it? I bought in at 75.

Its never wrong to make a profit.