Slopho

Distinguished Member

- Joined

- Jan 8, 2009

- Messages

- 5,291

- Reaction score

- 13

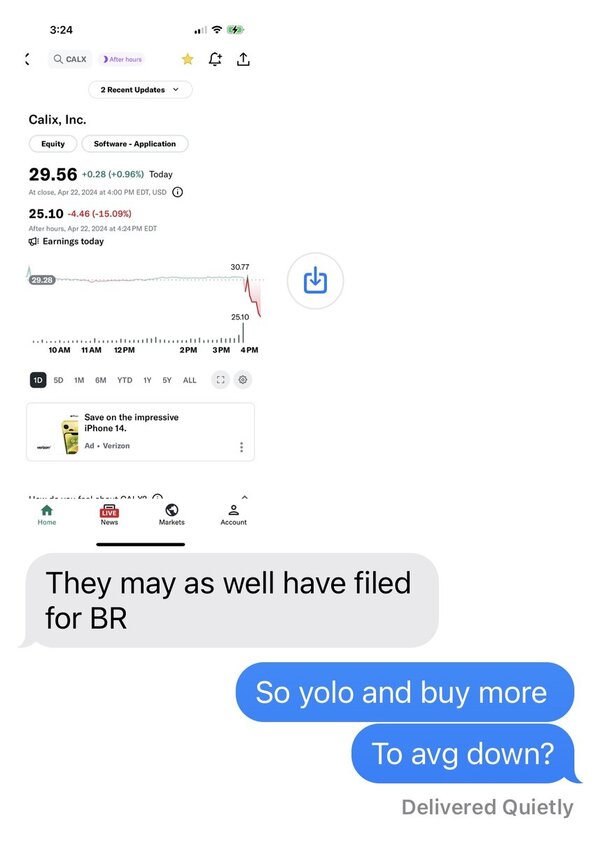

they were the best provider though(VZ)..

The thing about VZ too is that while they didn't have an "it" phone for a while they were busy rolling out cable and FIOS service. 4G service for S is good though, but not enough.