Support the forum

Navigation

-

- Men's Style

- Classic Menswear

- Streetwear and Denim

- Preorders, Group Made-to-order, trunk shows, and o

- Menswear Advice

- Former Affiliate Vendor Threads; a Locked Forum.

- Career and job listings in fashion, mens clothing,

-

- American Trench

- AMIDÉ HADELIN

- Archibald London

- The Armoury

- Arterton

- Besnard

- Canoe Club

- Capra Leather

- Carmina

- Cavour

- Crush Store

- De Bonne Facture

- Drinkwater's Cambridge

- Drop93

- eHABERDASHER

- Enzo Custom

- Epaulet

- Exquisite Trimmings

- Fils Unique

- Gentlemen's Footwear

- Giin

- Grant Stone

- House of Huntington

- IsuiT

- John Elliott

- Jonathan Abel

- Kent Wang

- Kirby Allison

- Larimars Clothing

- Lazy Sun

- LuxeSwap

- Luxire Custom Clothing

- Nicks Boots

- No Man Walks Alone

- Once a Day

- Passus shoes

- Proper Cloth

- SARTORIALE

- SEH Kelly

- Self Edge

- Shop the Finest

- Skoaktiebolaget

- Spier and MacKay

- Standard and Strange

- Bespoke Shoemaker Szuba

- Taylor Stitch

- TLB Mallorca

- UNI/FORM LA

- Vanda Fine Clothing

- Von Amper

- Wrong Weather

- Yeossal

- Zam Barrett

Install the app

More options

-

Hi, I am the owner and main administrator of Styleforum. If you find the forum useful and fun, please help support it by buying through the posted links on the forum. Our main, very popular sales thread, where the latest and best sales are listed, are posted HERE

Purchases made through some of our links earns a commission for the forum and allows us to do the work of maintaining and improving it. Finally, thanks for being a part of this community. We realize that there are many choices today on the internet, and we have all of you to thank for making Styleforum the foremost destination for discussions of menswear. -

This site contains affiliate links for which Styleforum may be compensated.

-

STYLE. COMMUNITY. GREAT CLOTHING.

Bored of counting likes on social networks? At Styleforum, you’ll find rousing discussions that go beyond strings of emojis.

Click Here to join Styleforum's thousands of style enthusiasts today!

Styleforum is supported in part by commission earning affiliate links sitewide. Please support us by using them. You may learn more here.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

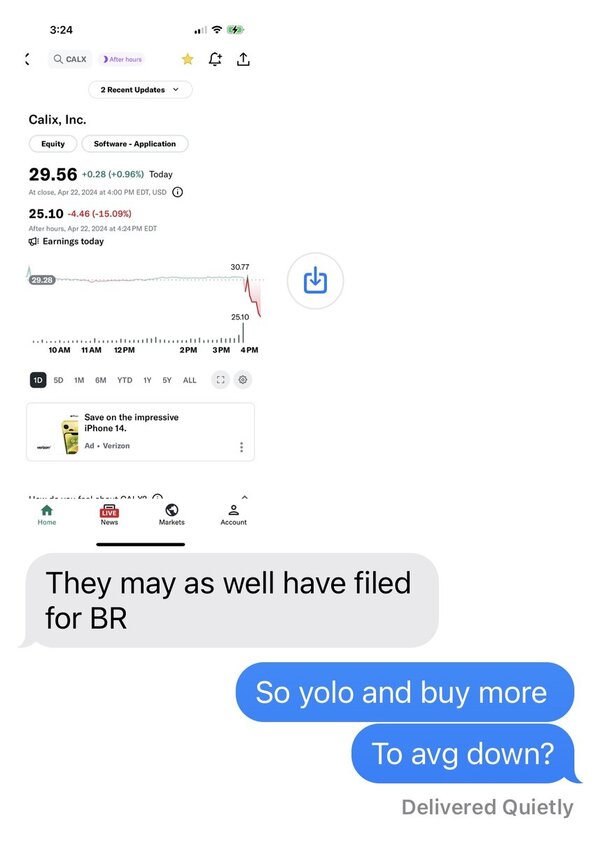

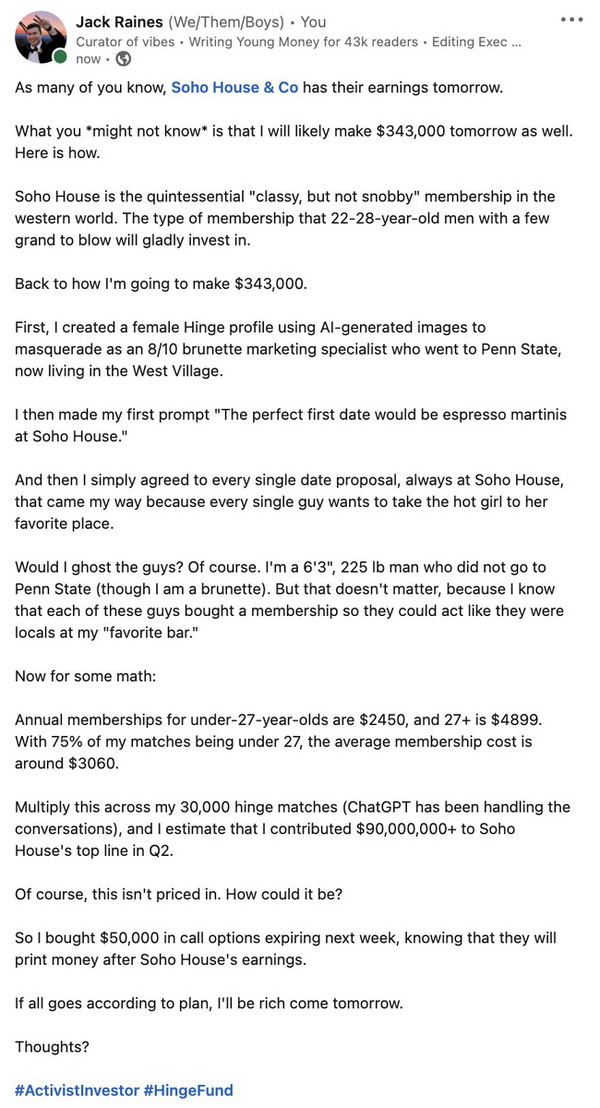

Talking stocks, trading, and investing in general

- Thread starter mikeman

- Start date

- Watchers 332

chickenfark

Senior Member

- Joined

- Nov 16, 2013

- Messages

- 800

- Reaction score

- 3,100

Up to now we have not had a taxable brokerage account - should I just open up an account at Vanguard? I assume they make it really easy to get set up?

I set up a Schwab account yesterday, super easy.

jbarwick

Distinguished Member

- Joined

- Nov 28, 2012

- Messages

- 8,738

- Reaction score

- 9,719

With VIX around 80, a VIX short instrument sounds interesting.

A few of those blew up during the crazy Vol in Dec 18

- Joined

- May 30, 2013

- Messages

- 16,938

- Reaction score

- 38,786

I've got a buddy in the airlines who could soon be in a tough spot, furloughed and bleeding cash on legal bills thanks to an ex-wife who has made it her life's mission to drag him back through the family court system every time he gets a raise. He's thinking about borrowing against his 401(k) to create a bigger cash reserve fund to hedge against the worst-case scenario (carrier goes bust, laid off, no one else is hiring in the short term). Given the demographics of the industry (huge wave of mandatory retirements coming up in next few years), he will be back flying and making good money again when the smoke clears, so there's no reason to think he couldn't pay it back in the mandated 5 years. Any other objections, or better ideas?

- Joined

- Nov 21, 2008

- Messages

- 28,633

- Reaction score

- 30,517

I've got a buddy in the airlines who could soon be in a tough spot, furloughed and bleeding cash on legal bills thanks to an ex-wife who has made it her life's mission to drag him back through the family court system every time he gets a raise. He's thinking about borrowing against his 401(k) to create a bigger cash reserve fund to hedge against the worst-case scenario (carrier goes bust, laid off, no one else is hiring in the short term). Given the demographics of the industry (huge wave of mandatory retirements coming up in next few years), he will be back flying and making good money again when the smoke clears, so there's no reason to think he couldn't pay it back in the mandated 5 years. Any other objections, or better ideas?

I would personally only borrow from my 401k as an absolute last resort. Does he own a home? Can he use a HELOC to provide a buffer if needed?

- Joined

- Oct 16, 2006

- Messages

- 38,393

- Reaction score

- 13,643

I don't know, I'd rather not lose my home. If you borrow against the 401k you pay yourself back with interest. Then again he might have to pull money when the market is ****...

- Joined

- Nov 21, 2008

- Messages

- 28,633

- Reaction score

- 30,517

I don't know, I'd rather not lose my home. If you borrow against the 401k you pay yourself back with interest. Then again he might have to pull money when the market is ****...

Why would you lose your home? My HELOC has a draw period of like 3 years, and the minimum payment is small.

- Joined

- May 30, 2013

- Messages

- 16,938

- Reaction score

- 38,786

Yeah, the advantage of borrowing against the 401(k) is there isn't a lender involved so you "pay interest" to yourself. That can be a significant saving. The main risk is, if you can't pay back any portion of the loan, that default is treated as as a distribution from the account and you are taxed accordingly. In his case, the one spoiler I see is there is a chance of employment termination, which then triggers a 60-day window for full payback to the plan. But he's not planning to spend the cash, just keep it in the bank as a cushion, so even that's mitigated it seems to me?

- Joined

- Oct 16, 2006

- Messages

- 38,393

- Reaction score

- 13,643

Omega, why don't you give him a loan.

- Joined

- May 30, 2013

- Messages

- 16,938

- Reaction score

- 38,786

Because he wouldn't accept it.

lawyerdad

Lying Dog-faced Pony Soldier

- Joined

- Mar 10, 2006

- Messages

- 27,006

- Reaction score

- 17,145

That was my question as well. A 401k isn’t a pension. You don’t lose it if the employer goes bankrupt. I could see taking a loan if you had an immediate cash need and didn’t have better borrowing options. But unless this is a convoluted form of market timing, why start the repayment clock just to create a cash reserve against future contingencies that may or may not ever happen?I'm confused, if he isn't going to spend the cash...why take the loan?

Presumably he could just take a cash position in his 401k and "know" that he could always take the loan if he does need it?

vdubiv

Distinguished Member

- Joined

- Oct 9, 2019

- Messages

- 1,763

- Reaction score

- 3,007

why start a cash reserve if your 401k is a cash reserve?That was my question as well. A 401k isn’t a pension. You don’t lose it if the employer goes bankrupt. I could see taking a loan if you had an immediate cash need and didn’t have better borrowing options. But unless this is a convoluted form of market timing, why start the repayment clock just to create a cash reserve against future contingencies that may or may not ever happen?

stimulacra

Senior Member

- Joined

- Dec 30, 2009

- Messages

- 366

- Reaction score

- 71

I've got a buddy in the airlines who could soon be in a tough spot, furloughed and bleeding cash on legal bills thanks to an ex-wife who has made it her life's mission to drag him back through the family court system every time he gets a raise. He's thinking about borrowing against his 401(k) to create a bigger cash reserve fund to hedge against the worst-case scenario (carrier goes bust, laid off, no one else is hiring in the short term). Given the demographics of the industry (huge wave of mandatory retirements coming up in next few years), he will be back flying and making good money again when the smoke clears, so there's no reason to think he couldn't pay it back in the mandated 5 years. Any other objections, or better ideas?

Borrowing against 401k should be a last resort. He would be cashing out at the bottom probably. He should swallow his pride and talk with his ex about some temporary relief. It's in her best interest for him to be professionally viable in his career if she has a long-view approach on things. That's assuming a lot though.

I would advise him to go rice-and-beans and cut all unnecessary expenses and moonlight or consult to get some additional revenue streams going. Start selling off his toys…

The main issue is that everyone is rushing for liquidity and cash reserves now…

- Joined

- May 30, 2013

- Messages

- 16,938

- Reaction score

- 38,786

Have no idea if this is the case, but one argument for locking in a loan would be if the 401(k) was heavily concentrated in the company's stock. You could get hit by the double whammy of a layoff and a price collapse that would reduce your available liquidity when actually needed. The limit is 50% of your vested balance or $50k, whichever is less.

FEATURED PRODUCTS

-

LuxeSwap Auction - Nicks Hand Made 2022 Hickory Brown Unlined Leather Boots The term indestructible is thrown around loosely sometimes, but this pair of Nicks Boots, offered up by LuxeSwap, might really be. Often discussed around the forum, Nicks handmade shoes are not for the faint of heart - or wallet - luckily, this is a no reserve auction that started at just $9.99.

LuxeSwap Auction - Nicks Hand Made 2022 Hickory Brown Unlined Leather Boots The term indestructible is thrown around loosely sometimes, but this pair of Nicks Boots, offered up by LuxeSwap, might really be. Often discussed around the forum, Nicks handmade shoes are not for the faint of heart - or wallet - luckily, this is a no reserve auction that started at just $9.99. -

Nicks Handmade Boots Americana - 60th Anniversary Sale! Fashioned after the classic service boot style, the Americana offers a timeless look on the HNW Last. This boot is built on the same last and has the same heel height as the Falcon.

-

John Elliott - 24 hr FLASH SALE The John Elliott Spring Sale is live. Take up to 50% off select styles + Stay tuned for Flash Sale events throughout the sale period

Latest posts

- Replies

- 49,751

- Views

- 4,302,174

- Replies

- 30,476

- Views

- 6,778,650

- Replies

- 18,081

- Views

- 2,951,018

- Replies

- 10,639

- Views

- 2,336,232

Similar threads

- Replies

- 77

- Views

- 131,881

Featured Sponsor

Forum Sponsors

- American Trench

- AMIDÉ HADELIN

- Archibald London

- The Armoury

- Arterton

- Besnard

- Canoe Club

- Capra Leather

- Carmina

- Cavour

- Crush Store

- De Bonne Facture

- Drinkwater's Cambridge

- Drop93

- eHABERDASHER

- Enzo Custom

- Epaulet

- Exquisite Trimmings

- Fils Unique

- Gentlemen's Footwear

- Giin

- Grant Stone

- House of Huntington

- IsuiT

- John Elliott

- Jonathan Abel

- Kent Wang

- Kirby Allison

- Larimars Clothing

- Lazy Sun

- LuxeSwap

- Luxire Custom Clothing

- Nicks Boots

- No Man Walks Alone

- Once a Day

- Passus shoes

- Proper Cloth

- SARTORIALE

- SEH Kelly

- Self Edge

- Shop the Finest

- Skoaktiebolaget

- Spier and MacKay

- Standard and Strange

- Bespoke Shoemaker Szuba

- Taylor Stitch

- TLB Mallorca

- UNI/FORM LA

- Vanda Fine Clothing

- Von Amper

- Wrong Weather

- Yeossal

- Zam Barrett

Members online

- Lkeck3

- BerryWall

- j ingevaldsson

- screaminmarlon

- WoolyLamb

- ysc2

- goatamous II

- idonotmatch

- smfdoc

- Bawow

- sleepy_hollows

- kami

- CLH03

- waramanga

- scrumtrulescent

- memoriastoica

- bmoney19

- YellowHandUp

- constant struggle

- Plato456

- Krausewitz

- Shiairemy

- pockets

- Ich_Dien

- ramdomthought

- Ameliaingram

- MajorDash

- xM.

- Kangnamstyles

- kettyjackson

- zack2322

- ceetee.cattuong@gmail

- Budd

- PricelessWorth

- JTMD

- mormonopoly

- Epaulet

- jazerad

- Shen

- noverbeck

- WBaker

- oynag

- Daniel Bryan

- jforjoel

- mebiuspower

- Gibonius

- kjb

- ccpl14

- Allen22

Total: 2,039 (members: 110, guests: 1,929)