- Joined

- Mar 8, 2012

- Messages

- 21,639

- Reaction score

- 41,904

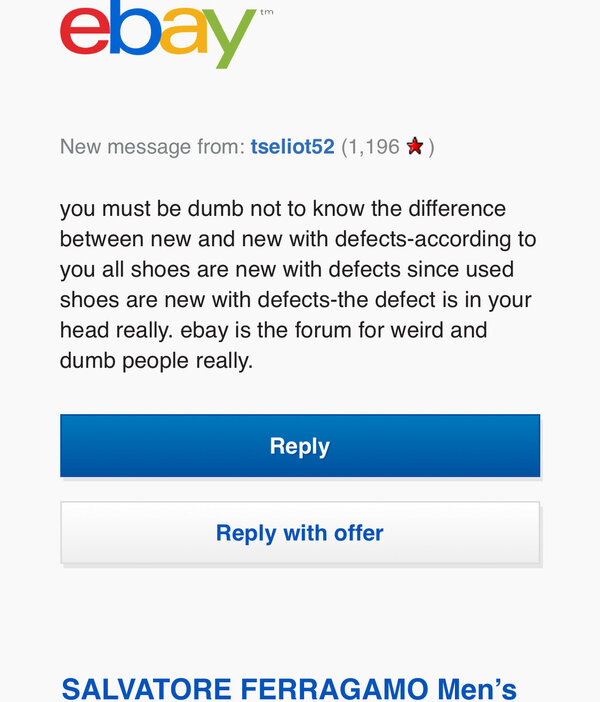

GF is Mexican...hope this helps.

Hola,

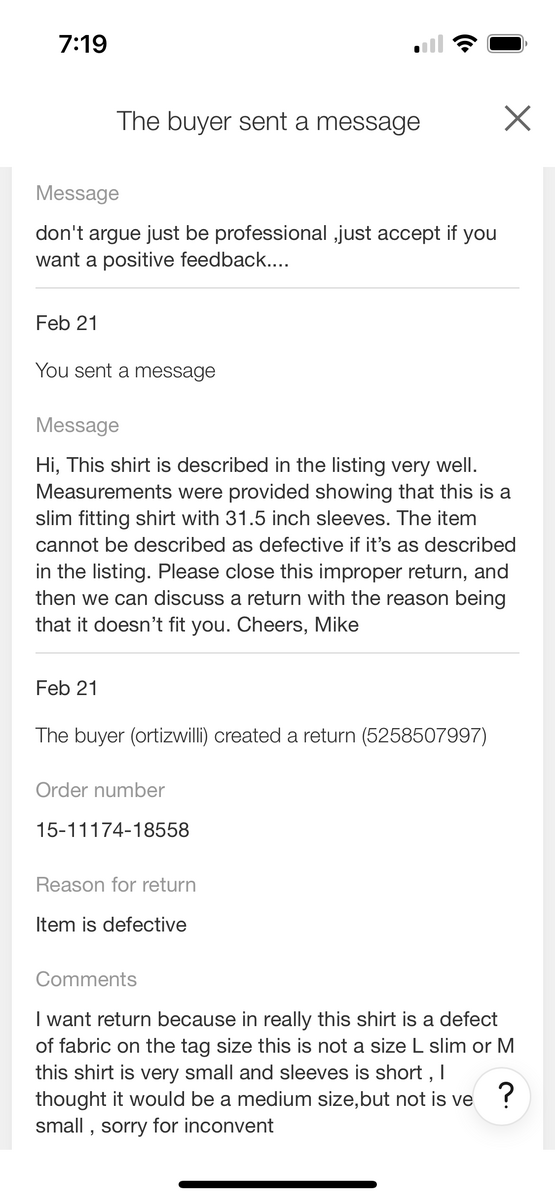

En los zapatos, unos de los "tacos" tapones se rompio durante el envio de correo. El "taco" se pude reponer, pero los zapatos estan completamente usables sin el "taco."

Gracias!

I concur. However, is the speaker Mexican or from some other central/south American country? There are differences within the diff Spanish variations.

You should be fine. It's a good translation. Never having been in this situation before on that site, if I were you, I'd write both just to be cautious. ie, "my friend translated this to Spanish"

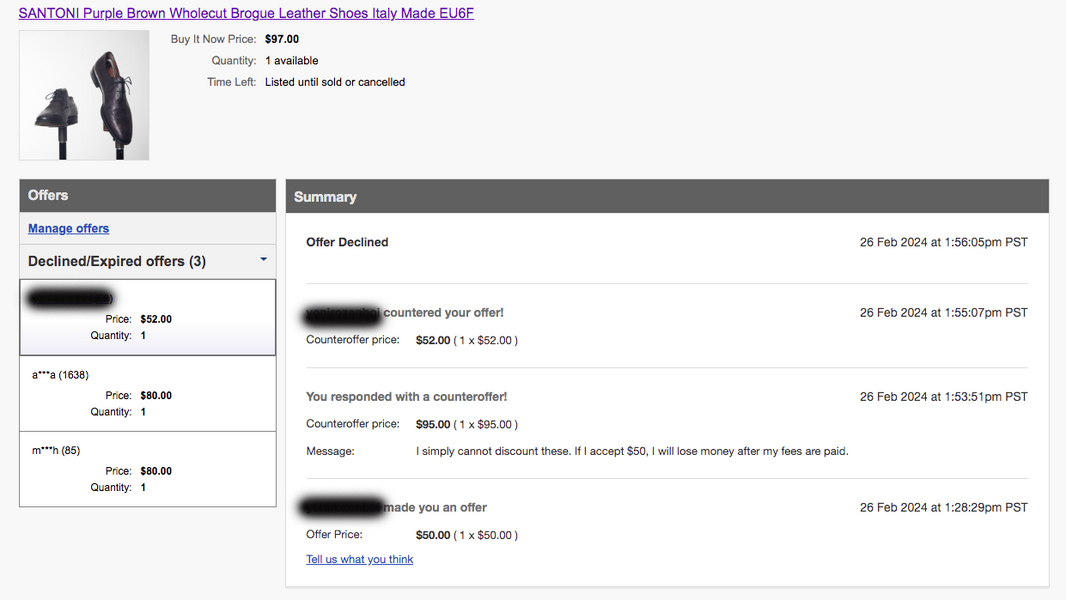

Thanks for the help, fellas! Before I was able to try the Spanish translation on the dude, someone from Thailand bought the shoes through a proxy company out of SoCal (why do all of these places seem to be in Compton?). At least I get cheap shipping!